HMRC Confirms Tax Hike for Extended-Cab Pick-Ups: What You Need to Know

From 6th April 2025, HMRC will reclassify extended-cab pick-ups as cars for tax purposes, meaning a significant increase in company car tax for business users. Previously, it was thought that only double-cab models would be affected, but HMRC has now confirmed that extended-cab pick-ups will face the same treatment.

What’s Changing?

Currently, pick-ups benefit from a lower, fixed-rate Benefit-in-Kind (BIK) tax as light commercial vehicles (LCVs). But from April 2025, both double-cab and extended-cab pick-ups will be taxed like company cars, with rates based on CO2 emissions and list prices. Since these vehicles tend to have high emissions and list prices, personal tax bills for whoever is using the vehicle will skyrocket by thousands in many cases.

Single-cab pick-ups, which HMRC still classifies as commercial vehicles, will not be affected and will retain their lower tax rate.

Impact on Business Owners

Previously, double-cab pick-ups did not give rise to a taxable benefit where private use was insignificant. Under the new classification, if the vehicle is available for private use, which means just being parked on your drive at night, it will now result in a taxable benefit.

Bear in mind, if you buy a second hand vehicle for say £15,000, you will be taxed on the price it was initially listed for when it was brand new.

An example vehicle is a Ford Ranger Wildtrak costing £46,000 (inc. VAT) brand new. The below tax example would also apply to the vehicle bought £20,000 second hand or even leased from a hire company.

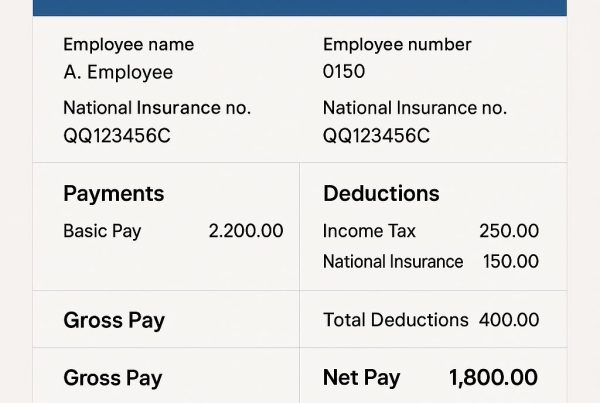

If used incidentally for private travel and with diesel provided by your company, under the new 2025/26 tax rules, the tax impact will be around:

| Tax Element | Current Treatment | New 2025/26 Rules |

| Value of Car Benefit | £0 | £17,020 |

| Value of Fuel Benefit | £0 | £10,286 |

| Income Tax Payable by director/employee (Higher Rate Taxpayer) | £0 | £10,922 |

| Class 1A NIC Payable by Employer | £0 | £4,095 |

| Total Annual Tax Cost | £0 | £15,017 |

What Can You Do?

Act before 5th April 2025 – If you’re considering a pick-up for business, purchasing or leasing before 6 April 2025 will allow you to lock in the current tax treatment until at least 5 April 2029 (or until disposal or lease expiry).

Plan for tax-efficient vehicle strategies – Businesses should assess the tax impact and explore alternative vehicle options, such as single-cab pick-ups or alternative commercial vehicles.

Understand VAT rules – The VAT treatment remains unchanged, meaning businesses can still reclaim VAT on pick-ups with a payload of 1 tonne or more.

Seek professional advice – Understanding the full implications on your tax position is essential. Speak with your accountant or tax advisor to ensure you’re making the right financial decisions.

Final Thoughts

This change significantly increases costs for businesses using double and extended-cab pick-ups. If your company relies on these vehicles, now is the time to take action. Review your options and make informed decisions before April 2025 to minimise your tax bills.

Need help with these changes? Get in touch today to discuss how this will impact your business.