Yes but, when hiring a new employee, the P45 form plays a crucial role in ensuring accurate tax deductions and providing important information about the employee’s previous employment. However, there are instances where an employee may not have a P45. In this blog post, we will explore the implications and procedures involved when taking on an employee without a P45.

What is a P45?

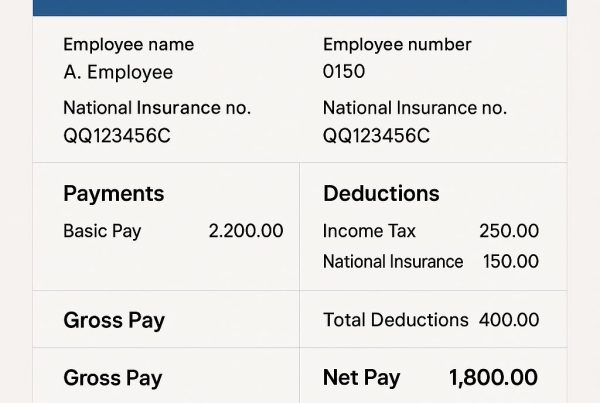

A P45 is a document issued by an employer when an employee leaves a job. It contains information about the employee’s earnings, tax code, and National Insurance contributions made during their employment. It helps the new employer determine the employee’s tax obligations and ensures correct tax deductions.

Hiring an Employee without a P45: If an employee does not have a P45, the following steps should be taken:

a. Employee Declaration Form: Ask the employee to complete an Employee Declaration Form (e.g., HMRC Starter Checklist). This form gathers essential details about the employee’s employment history, tax code, and any benefits or deductions that should be considered.

b. Tax Code Verification: Contact HM Revenue & Customs (HMRC) or use the online HMRC Basic PAYE Tools to verify the employee’s tax code. This ensures that the correct amount of tax is deducted from their wages.

c. Starter Checklist: In certain cases, HMRC may instruct the employer to provide the employee with a Starter Checklist. The employee completes this form to provide additional information about their financial circumstances, which helps determine the appropriate tax code.

d. Reporting to HMRC: As the employer, you are required to report the employee’s employment details to HMRC using a Full Payment Submission (FPS) or Employer Payment Summary (EPS). This includes the employee’s start date, pay details, and tax code.

Emergency Tax: When hiring an employee without a P45, they may be placed on an emergency tax code until their tax situation is clarified. The emergency tax code ensures that they receive basic tax allowances. However, this may result in over or underpayment of tax, which should be adjusted once the correct tax code is confirmed.

Ongoing Employee Tax Obligations: As the employer, you have ongoing responsibilities for managing the employee’s tax deductions, including:

Deducting the correct amount of income tax and National Insurance contributions from their wages.

Submitting payroll reports to HMRC in a timely manner.

Ensuring accurate tax records and documentation are maintained.

If you encounter complexities or uncertainties when hiring an employee without a P45, it is advisable to speak to us, or HMRC directly. We provide tailored advice and ensure compliance with tax regulations.

Hiring an employee without a P45 is possible, albeit with additional administrative steps. By following the appropriate procedures, including obtaining an Employee Declaration Form, verifying the tax code, and reporting to HMRC, you can ensure compliance with tax obligations. We have a complete payroll bureau so speak to us now.