The government announced the removal of higher rate tax relief, in effect restricting tax relief on mortgage interest to basic rate. Changes came into effect from April 2017.

Do the changes in mortgage relief affect me?

The changes will impact most private landlords of investment portfolios, especially those funded by mortgages and loans, or those loss making rental businesses. There are, however, a number of businesses not affected, namely commercial letting, furnished holiday letting and property businesses operated by limited companies.

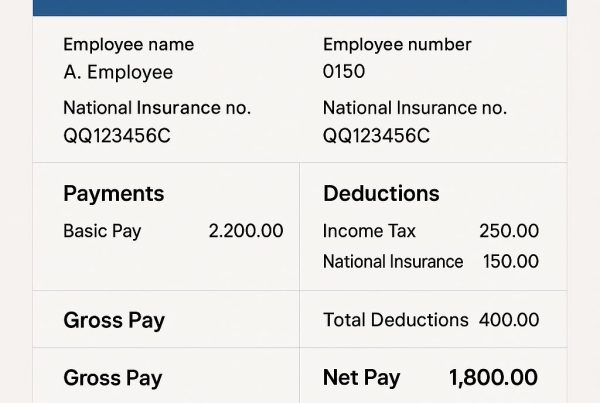

The amount of mortgage interest tax relief will fall each year (shown below), and by April 2020, you won’t be able to deduct all of your mortgage expenses from rental income to reduce your tax bill.

2017-2018 tax year, you can claim 75% of your mortgage tax relief

2018-2019 tax year, you can claim 50% of your mortgage tax relief

2019-2020 tax year, you can claim 25% of your mortgage tax relief

How do the changes in mortgage interest relief affect my tax?

Let’s look at an example using a higher rate taxpayer receiving £15,000 in rents per year and paying £10,800 in mortgage interest.

2016-2017 tax year you can claim 100% mortgage tax relief, your tax bill would be £1,680

2018-2019 tax year you can claim 75% mortgage tax relief, your tax bill would be £2,200

2018-2019 tax year you can claim 50% mortgage tax relief, your tax bill would be £2,760

2019-2020 tax year you can claim 25% mortgage tax relief, your tax bill would be £3,300

From the 2020 tax year you can claim no mortgage tax relief, your tax bill would be £3,840

The tax impact is significant, tax bills will more than double by 2020.

Is it worth Incorporating?

Upon incorporation, additional taxes would be payable such as stamp duty and capital gains tax if you transfer your property into a company. It would be deemed a market value disposal for capital gains tax purposes. If your buy-to-let property has gone up in value since you acquired it, you would have to pay capital gains tax. This could be as high as 28%. Also, transferring a property into a company will give rise to a stamp duty charge.

The main rate of corporation tax is reducing to 18 per cent by 2020, further increasing the difference between corporate and personal tax rates, making companies more attractive in some cases.

How can I access cash from my company?

If you want to draw some money from the company, one option is to take the money in the form of a dividend. The first £2,000 of dividend is tax free, additional dividend income will be charged at 7.5 per cent for basic rate taxpayers, 32.5 per cent for those on the higher rate and 38.1 per cent for the additional rate band.

Summary

For buy to let investors it is probably best to set up a company especially if you intend to acquire addition properties, or, if you want to roll up the money and don’t need access to it. You could just use it to build up a pension pot for when you retire.