Can I Put That Through the Business?

What Expenses Are Allowed and What’s Not For Company Directors and Limited Companies

One question we get asked a lot by directors is “Can I put this through the business?” Whether it’s lunch with a client, a new car, or even a pet’s vet bill (yes, we’ve seen it all!), it’s important to know what costs you can and can’t claim for.

Getting it wrong can mean missing out on tax savings or put you at risk of a nasty letter from HMRC.

In this blog we’ll break it down, so you know exactly what’s allowed and what’s not!

The Golden Rule of Business Expenses

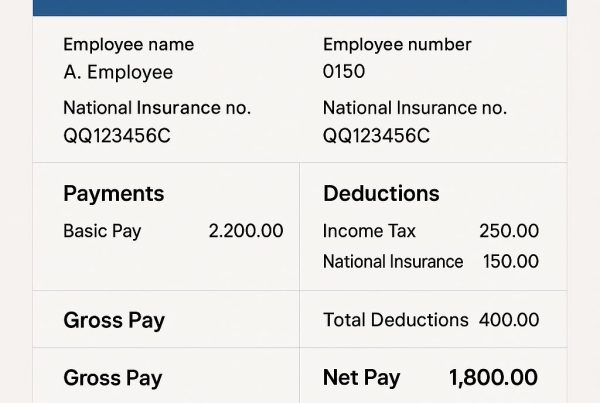

HMRC rules say an expense must be “wholly and exclusively” for business purposes to be tax-deductible.

- If the expense is 100% for the business, it’s claimable.

- If it’s part-business, part-personal, then you can only claim the business portion.

- If it’s personal and has no benefit to the business, then it’s a no-go.

Sounds simple, right? Well… here’s where things get tricky.

What You Can Claim Through the Business

Office Costs & Equipment – Laptops, printers, software, stationery, postage, and even office furniture. If you work from home, you can claim a portion of your bills (more on that later).

Travel & Mileage – Business travel including trains, flights, taxis, and hotels. If you use your personal car, you can claim 45p per mile for the first 10,000 miles and 25p per mile after that. But…

❌ Mileage for commuting from home to your usual place of work doesn’t count!

Vans and electric vehicles – Vans are classed as commercial vehicles, so fuel, insurance, repairs and road tax are all claimable. Electrical vehicles have great tax saving incentives at the moment and are treated as similar for tax deduction purposes.

Never pay for any private car expenses through your company. The personal tax charges are usually eye watering, so keep to mileage as above with personal vehicles.

Marketing & Advertising – Social media ads, website costs, business cards, sponsorships, and branding. If you take a client for a business-related event (e.g., a networking lunch), this might be claimable – but general client entertainment is NOT tax-deductible.

Professional Fees – Accountants (like us!), solicitors (for business matters), business insurance, and financial advice related to your company.

Staff Costs & Training – Wages, pensions, recruitment fees, and training courses that enhance business skills. But if you’re learning something unrelated (e.g., a director taking a photography course for fun), that’s not allowable.

Subscriptions & Memberships – If it’s relevant to your business, you can claim professional memberships or trade publications. Netflix for “business research?” Nice try, but no!

Mobile Phones & Internet – If the contract is in the company’s name, the full cost is claimable. If it’s a personal contract, it’s generally not allowable as limited company expense.

What You Can’t Claim Through the Business

Personal Expenses Disguised as Business – HMRC isn’t fooled easily. Trying to claim your weekly food shop, new TV, or designer handbag as a “work necessity” won’t pass the test.

Clothing (Unless It’s Uniform or Protective Gear) – Normal clothing isn’t deductible, even if you only wear it for work. However, branded uniforms, PPE, or specialist clothing (e.g., a construction worker’s steel-toe boots) are allowed.

Entertaining Clients – Fancy dinners, drinks, and golf days might build relationships, but they’re NOT tax-deductible. However, you can still pay for them through the business, just without tax relief with it being disallowed in the corporation tax calculation.

Gym Memberships & Personal Training – Unless you own a fitness business or it’s for staff (and even then, it’s tricky), gym memberships and personal trainers aren’t claimable.

Childcare & School Fees – Even if you work from home, childcare isn’t a business expense. However, you can set up a tax-free childcare scheme to save money on nursery fees.

Holidays & Luxury “Business Trips” – A weekend in Dubai with a “quick Zoom call” to a supplier won’t cut it. Business trips must be genuinely for work, not a disguised holiday.

Can I Claim Home Office Expenses?

Yes! If you run your business from home, you can claim a portion of your household bills for tax relief.

There are two ways to do this:

- Simplified Method – If you work more than 25 hours a month from home, you can claim a flat rate (between £10-£26 per month, depending on hours worked). No receipts needed!

- Actual Costs Method – It’s a more complex calculation, but as an idea if your home office takes up 10% of your house, you can claim 10% of your bills (e.g., electricity, gas, mortgage interest, broadband).

What Happens If You Get It Wrong?

If you accidentally claim for personal expenses, HMRC could:

Disallow the expense and make you pay the extra tax.

Charge penalties for incorrect returns (up to 100% of the tax due).

Investigate your business further if they suspect foul play.

If in doubt, ask your accountant or us! It’s better to check before claiming something questionable.

Final Thoughts: Keep It Legit & Save Tax the Right Way

Claiming all legitimate expenses is a smart way to reduce tax and boost profits—but trying to sneak in personal costs isn’t worth the risk.

If you’re unsure about an expense, drop us a message! We’ll help you claim everything you’re entitled to—without getting on HMRC’s bad side! We use Dext with our clients to help make sure they claim for everything!