For April 2024, there are several key accountancy dates to keep in mind, affecting various tax and payroll responsibilities:

- 1st April: Changes to National Living Wage (NLW) and National Minimum Wage (NMW) rates take effect, along with significant adjustments to R&D tax relief and rules around subcontracted R&D work, affecting only work done in the UK.

- 5th April: Marks the last day of the tax year, with deadlines for claiming tax refunds.

- 6th April: Start of the new tax year, with several tax changes kicking in, including adjustments to the Dividend Allowance, Capital Gains Tax Annual Exempt Amount, the abolition of the Pension Lifetime Allowance, changes to Class 2 and Class 4 NIC rates, and the introduction of the Government’s new penalty regime for late filing and payment of taxes. Also, the tax year basis transition concludes.

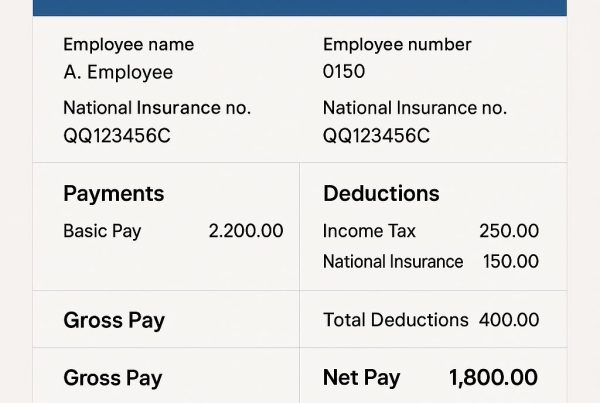

- 19th April: Deadline for employers to make a final RTI payroll report for the 2023/24 tax year.

- 22nd April: Deadline for electronic remittance of PAYE, NICs, and CIS to HMRC for employers.

- 30th April: A deadline for various filings and payments, including the Daily £10 late filing penalties for outstanding Self-Assessment tax returns starting to apply.

Additionally, VAT returns and payments due for various quarterly periods are typically due one month and seven days after the end of the VAT period, with specific dates such as 7th May for the period ending 31st March.