When you’re running your own business, life can feel like it’s at 100mph! Sometimes it feels like you don’t have much time for your family, hobbies, keeping fit or even eating! You can feel overwhelmed with thoughts of how much tax you’ve got to pay, staff issues, how to grow the business and even “am I doing things right?”

We know this because we’re business owners ourselves and these are the questions most of our clients have asked themselves at some point!

Not blowing our own trumpet, but one solution might be to try using the services of an accountant or business adviser. In this blog we’ll list a load of ways this could help you free up some time, ease your worries and help you save and earn more cash!

Accounts and tax returns

We’ll start with the most obvious thing people relate accountants to: accounts and tax returns! Unless you’re trained in preparing accounts and tax returns or you have a very simple business, doing your own accounts and tax returns can be very stressful and time consuming. Would you be confident that everything is correct and you’re not paying too much or not enough tax?

There can be heavy fines from HMRC and Companies House for getting things wrong or missing deadlines. Admittedly some accountants make mistakes, but most good accountants will file within the deadlines with the correct amount of tax calculated. So having a professional prepare and file your accounts will take away the pain.

Book-keeping

Keeping your accounts up to date can be a headache for most business owners. Where do you start? Files of paperwork? Spreadsheets? Boxes of receipts? Written invoices or typed up in Word? An accountant can advise you on the best systems to use in your business to keep your book-keeping down to a minimum and save lots of time and stress.

With the technology now available, using a combination of something like Xero, Receipt Bank and a point of sale system like Square or Izettle will automate your bookkeeping and data will automatically feed into your accountant, letting them advise you in real time and not months after your year end.

For example: if your sales are approaching the VAT registration threshold of £85k, your accountant can register you for VAT at the right time and start submitting VAT returns for you. Penalties from HMRC for not registering and charging VAT from the correct date can be up to 15% of any VAT due, so registering at the correct time is important.

Staff and payroll

If you have employees, you have a lot of responsibilities! Payslips, RTI submissions and auto enrolment! Sick pay, maternity pay and minimum wage! Staff contracts, holiday pay and disciplinary procedures! There are many more! Employees are one of the biggest headaches for most business owners and having an accountant there to help you along the way can be priceless.

Technology

A lot of businesses are still using manual paper systems, which can be time consuming, inaccurate and vulnerable to fire or security issues. An accountant can have a look at your business processes and advise you on what technology can help. Here are a few of the apps we recommend:

Xero – Accounting software that helping with invoicing and book-keeping.

ReceiptBank – Used to capture your expenses and receipts.

GoCardless – Helps you get paid by customers.

Chaser – Automated credit control.

Square or iZettle – Point of sale system and card machine.

Tawk – Website live chat helps increase website sales.

Loomly – Social media scheduler

There are loads more apps that link to Xero that can help with all kinds of things.

Improve profit and cashflow

Having an expert look at your business from a different angle can be a big help. Is your pricing right? What are you doing for your marketing? Do you need help with sales strategies? Is your website working to its full potential? These are all things that can improve profits and cash flow.

If you need finance or want to expand, employ more staff or buy new equipment, having an accountant prepare a business plan and cash flow forecasts can help you achieve these goals.

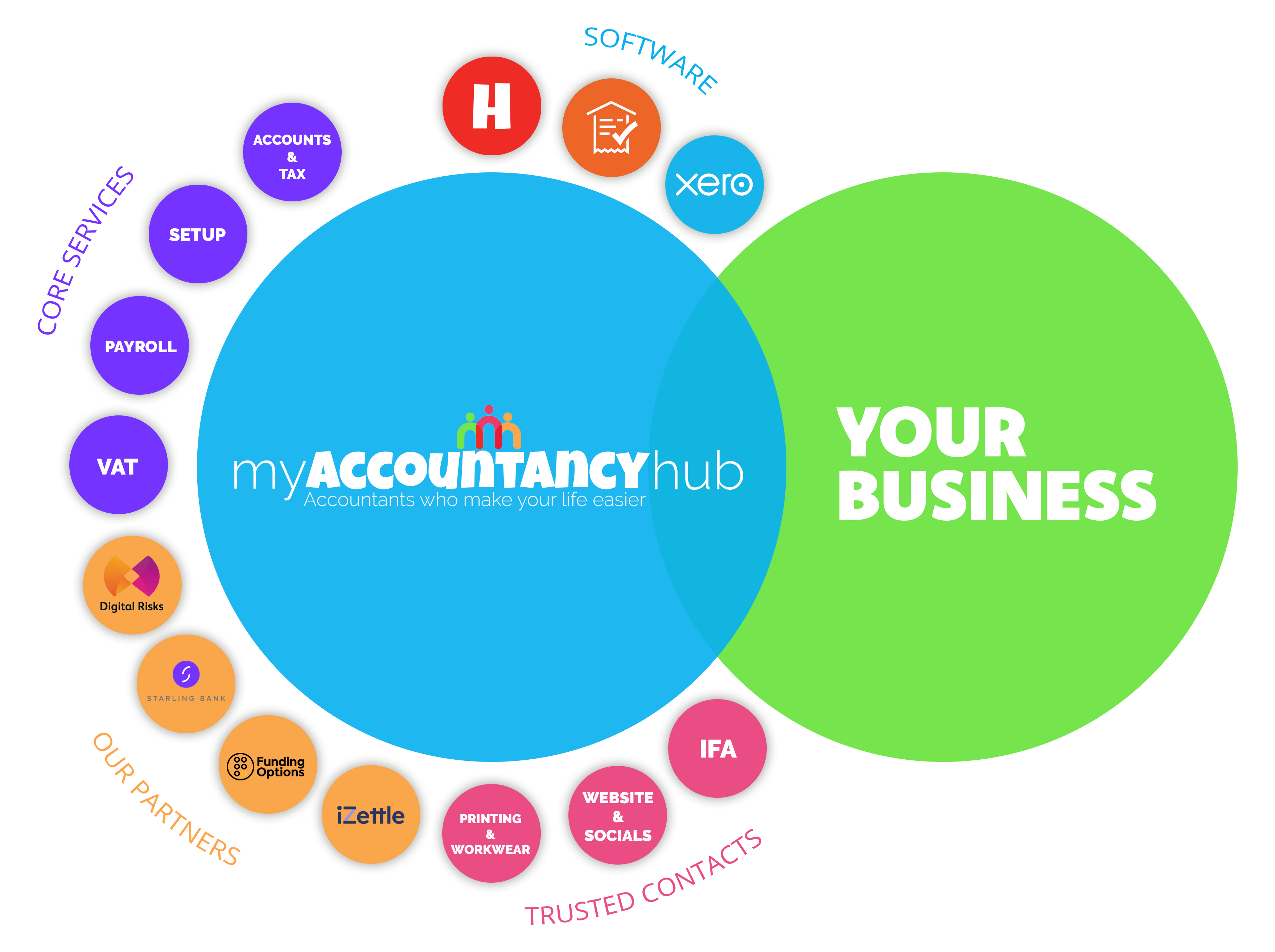

Trusted partners and discounts

Using an accountant can give you access to trusted business partners and discounts that may be available. This saves time and money finding quality products and services.

Get 10% off your business insurance with Digital Risks.

Find the right loans and funding for your business with Capitalise.

3 months’ free transaction fees with GoCardless

Grow your social media marketing with Socialista Media.

Get your workwear and design @ VC Creative.

If you need any advice on mortgages, pensions or investments speak to Chris Lunt IFA.

Xero – The cost of Xero if you buy it directly is £10-£24 plus VAT per month. Subscribed through us, it’s between £5 and £20 plus VAT per month. We get a discount and access to partner subscriptions to meet your needs.

Receipt Bank – Bought directly ReceiptBank costs £10 plus VAT per month for 50 receipts and 1 user, rising to £50 per month plus VAT for up to 3,000 receipts and 20 users. We charge between £5 and £20 plus VAT per month, depending upon how big your business is, and this gives you unlimited amounts of receipts and users.

Feel like you’re in control

If you’re using the book-keeping technology we’ve mentioned, your accountant will be able to give you regular updates on profits and tax liabilities, so you don’t get hit with any unexpected tax bills that will affect your cash flow and savings! You’ll be able to make decisions as you go and be confident you’re not taking too many risks. You’ll also know if you’re hitting targets and the business is performing as expected.

We have a new service launching soon called Hubflow. This gives clients access to a live dashboard showing information that’s tailored to their business needs. You can keep track of key performance indicators and receive live alerts for agreed triggers. For example: when the business bank account reaches a certain amount, if gross/net profit falls below a certain level or if spending on a particular cost exceeds a limit, you’ll get an alert via email and we can look into things and act as soon as it happens. Keep an eye on our social media posts for more news of this!

Finally!

In a lot of cases, paying an accountant will pay for itself in terms of tax savings, profit growth, discounts available, time savings and avoiding fines. Having less stress and peace of mind will also be a benefit.

Speak to a few accountants, check out their websites and social media and see if they will provide you with value for your money! If you buy cheap chocolate, you’ll often feel underwhelmed and need to go out and buy the good stuff! If you buy cheap tyres, they often wear down fast and you need to replace them! Often using the cheapest accountant doesn’t work out as well! If you pay a low fee how can you expect a high level of service? Instead of seeing accountancy fees as a monthly expense, start viewing the cost as a great investment!

As always you know where we are if you need any help!