The Impact of Rising Interest Rates on Tax Payable on Savings Income in the UK

In recent months, interest rates in the UK have been on the rise. While this may sound like good news for savers, it’s important to consider the tax implications that come with higher interest earnings. Understanding how these changes affect your savings income is crucial for effective financial planning. In this blog, we’ll explore the relationship between rising interest rates and the tax payable on your savings income, offering insights to help you navigate this evolving landscape.

Understanding the Basics: Interest Rates and Savings Income

Interest rates, set by the Bank of England, influence the amount of interest you earn on your savings. When interest rates increase, banks and financial institutions typically raise the rates they offer on savings accounts. While this means more income from your savings, it also means potential changes in the amount of tax you owe on that income.

How Savings Income is Taxed in the UK

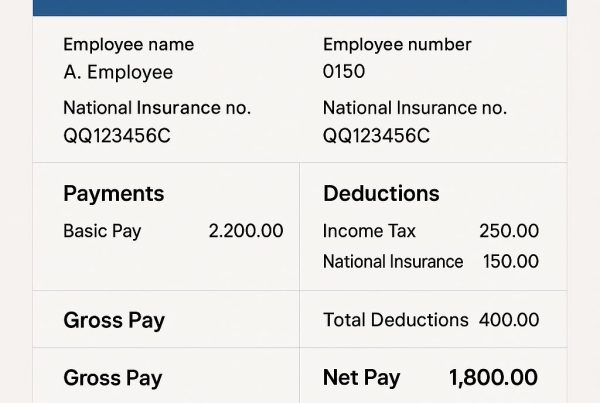

In the UK, the tax you pay on savings interest depends on your total income and the tax band you fall into. Here’s a brief overview:

Personal Savings Allowance (PSA): Introduced in April 2016, the PSA allows you to earn a certain amount of interest tax-free each year. Basic rate taxpayers can earn up to £1,000, higher rate taxpayers up to £500, and additional rate taxpayers have no PSA.

Basic Rate Taxpayers: Pay 20% tax on savings income exceeding the PSA.

Higher Rate Taxpayers: Pay 40% tax on savings income exceeding the PSA.

Additional Rate Taxpayers: Pay 45% tax on all savings income, as they do not receive a PSA.

The Effect of Rising Interest Rates on Your Tax Bill

As interest rates climb, the amount of interest you earn from your savings grows. This increase can push your savings income above the PSA threshold, especially if you’re a basic or higher rate taxpayer. Here’s how it might affect different taxpayers:

Basic Rate Taxpayers: If the interest from your savings exceeds £1,000, you’ll start paying 20% tax on the excess. For example, if you earn £1,500 in interest, you’ll pay tax on £500, resulting in a £100 tax bill.

Higher Rate Taxpayers: With a PSA of £500, any interest over this amount will be taxed at 40%. So, if you earn £1,200 in interest, you’ll pay tax on £700, resulting in a £280 tax bill.

Additional Rate Taxpayers: Since there is no PSA for additional rate taxpayers, all interest earned is taxable at 45%. If you earn £2,000 in interest, your tax bill will be £900.

Strategies to Manage the Impact

Rising interest rates and their tax implications don’t mean you should avoid saving. Instead, consider these strategies to manage your savings income and tax efficiently:

Utilize ISAs: Individual Savings Accounts (ISAs) allow you to earn interest tax-free. The annual ISA allowance is £20,000, so maximizing this can help reduce your taxable savings income.

Diversify Your Investments: Consider other tax-efficient investments like stocks and shares ISAs or pensions, which offer different tax advantages.

Monitor Your Savings Accounts: Regularly review your savings accounts to ensure you’re getting the best interest rates while managing your tax liabilities.

Seek Professional Advice: A financial advisor can provide personalized strategies to optimize your savings and minimize tax.

Conclusion

As an accounting firm, we cannot advise on investment strategies. But if you want to discuss your savings plans with an independent financial adviser (IFA), talk to us and we’ll arrange an introduction. Rising interest rates can boost your savings income, they also have the potential to increase your tax liability. By understanding how savings income is taxed and implementing smart strategies, you can make the most of your savings while keeping your tax bill in check. Stay informed, plan ahead, and consider seeking professional advice to navigate this changing financial landscape effectively.

By staying proactive and informed, you can ensure that rising interest rates work in your favor, enhancing your savings without an unexpected tax surprise.