The UK government’s Making Tax Digital (MTD) initiative is transforming the way businesses manage their tax obligations. If you’re a small or medium-sized business owner, staying ahead of these changes can save you time, reduce errors, and improve cash flow. In this guide, we’ll break down what MTD is, how it affects you, and what steps you need to take to stay compliant.

What is Making Tax Digital (MTD)?

MTD is a government initiative designed to modernise the UK tax system by making it more efficient, effective, and easier for businesses to get their taxes right. The key goal is to replace paper-based and manual record-keeping with digital solutions, ensuring businesses report their tax information accurately and on time.

Who Does MTD Apply To?

MTD is being rolled out in stages, affecting different businesses at different times:

- VAT-registered businesses with a turnover above £85,000: Already required to follow MTD for VAT since April 2019.

- All VAT-registered businesses (regardless of turnover): Required to comply with MTD for VAT from April 2022.

- Self-employed individuals and landlords with income over £50,000: Must comply with MTD for Income Tax from April 2026.

- Self-employed individuals and landlords with income over £30,000: Will need to follow MTD for Income Tax from April 2027.

Corporation tax is expected to be brought into MTD at a later date, but no firm timeline has been set.

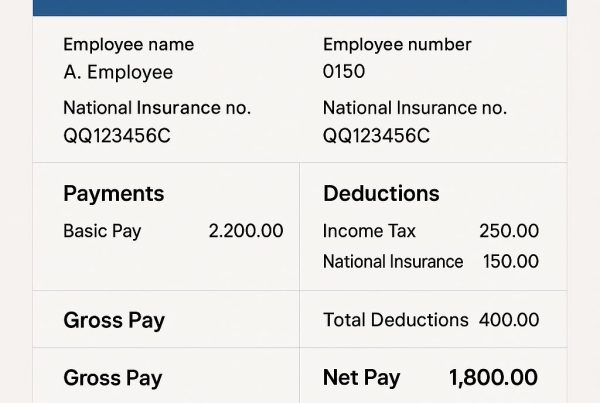

What Are the Main Requirements Under MTD?

To comply with MTD, businesses must:

- Keep Digital Records: Paper records are no longer acceptable. Businesses must maintain digital records of income, expenses, and VAT returns using compatible software.

- Use MTD-Compatible Software: Spreadsheets alone won’t meet MTD requirements unless linked to HMRC-approved software. Options include Xero, QuickBooks, FreeAgent, and Sage.

- Submit Tax Returns Digitally: VAT-registered businesses must file their VAT returns via HMRC-approved software. Soon, self-employed individuals and landlords will also need to submit digital income tax updates quarterly.

What Are the Benefits of MTD?

Many business owners initially see MTD as just another compliance hurdle, but it actually offers several advantages:

- Reduced Errors: Automation minimises mistakes in tax calculations and submissions.

- Time Savings: Digital records simplify tax filing, reducing admin time.

- Better Cash Flow Management: Quarterly reporting helps businesses stay on top of their finances and avoid unexpected tax bills.

- Easier Compliance: Using MTD-compatible software ensures tax records are kept in line with HMRC requirements.

How to Prepare for MTD

- Check If You’re Affected: Review whether your business falls under the MTD requirements now or in the near future.

- Choose the Right Software: If you’re not already using MTD-compatible software, we recommend Xero.

- Digitise Your Records: Transition from spreadsheets or paper records to a digital bookkeeping system.

- Stay Updated: HMRC continues to expand MTD, so keep an eye on future changes.

- Seek Professional Help: If you’re unsure about compliance, an accountant can help set up your systems and ensure everything runs smoothly.

Need Help with MTD?

Navigating MTD can feel overwhelming, but you don’t have to do it alone. Our team specialises in helping small and medium-sized businesses transition to digital tax reporting with minimal hassle. Get in touch today for expert guidance and ensure you stay compliant without the stress.

Final Thoughts Making Tax Digital isn’t just about following the rules—it’s an opportunity to modernise your business, improve efficiency, and gain better control over your finances. By acting now, you can avoid last-minute stress and take advantage of the benefits MTD has to offer.

If you have any questions or need support, feel free to reach out—we’re here to help!