Accounting for Social Media Marketers: A Guide to Financial Success

As a social media marketer, you’re likely focused on creating compelling content, building engagement, and driving results for your clients or brand. But while your creative side shines, it’s essential not to overlook the financial aspect of your business. Accounting might not seem exciting, but keeping your books in order is crucial for long-term success.

This guide will help social media marketers understand the key elements of accounting, allowing you to grow your business, make better decisions, and, most importantly, avoid financial headaches.

1. Why Accounting Matters for Social Media Marketers

Whether you’re a freelancer, an agency owner, or managing social media in-house, having control over your finances can give you a competitive edge. Here’s why:

– Tax Compliance: Tracking income and expenses ensures that you meet legal obligations and avoid unexpected tax bills.

– Profitability Insights: Proper accounting helps you understand which projects, clients, or campaigns are the most profitable.

– Cash Flow Management: Monitoring your cash flow keeps your business afloat, ensuring you can cover expenses and invest in growth.

– Financial Planning: Knowing your numbers lets you set realistic goals and budget for software, ads, or even expanding your team.

2. Key Accounting Terms to Know

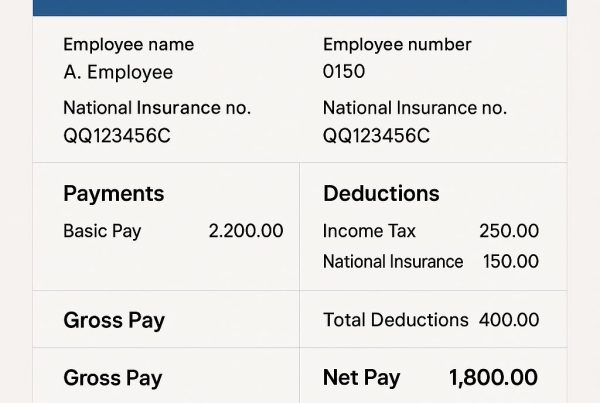

Understanding basic accounting concepts can demystify your finances and help you stay on top of things. Here are a few essential terms:

– Revenue: The income you earn from your social media services, whether through client work, consulting, or product sales.

– Expenses: Costs incurred in running your business, such as software subscriptions, equipment, and advertising costs.

– Profit: The difference between your revenue and expenses. This is the money left over after covering all costs.

– Accounts Receivable: Money clients owe you for work completed. Tracking this ensures you’re getting paid on time.

– Accounts Payable: Bills you owe, such as vendor payments or software subscriptions. Managing these helps you avoid late fees.

3. Setting Up Your Accounting System

Start with a basic accounting system to keep your finances organized. Here’s a quick guide:

– Choose Cloud Accounting Software: For marketers on the go, cloud accounting software like Xero and Dext is ideal. These platforms allow you to track income, expenses, and invoices in one place.

– Separate Business and Personal Finances: Open a separate business bank account and credit card to avoid mixing personal and business expenses. This will make your life much easier when it comes to tax season.

– Track Expenses: Keep an eye on all your business expenses, including:

– Social media tools (e.g., Hootsuite, Canva)

– Advertising costs (e.g., Facebook Ads, Google Ads)

– Professional services (e.g., consultants, contractors)

– Office supplies and equipment

– Travel, if it’s business-related

– Invoicing: Ensure you have a consistent system for invoicing clients. Many accounting platforms automate this process, sending reminders and tracking overdue payments.

4. Budgeting for Growth

To thrive as a social media marketer, you need a budget that aligns with your growth goals. Here are a few tips:

– Set Aside Money for Taxes: A common mistake marketers make is not setting aside enough for taxes. As a freelancer or business owner, you’ll need to save for income tax, VAT (if applicable), and potentially other self-employment taxes.

– Plan for Investment: Allocate part of your budget toward tools and education that will enhance your services, such as social media courses, new software, or hiring help.

– Save for Slow Months: The marketing industry can be cyclical, with periods of high demand followed by slower months. Having a financial cushion can help you weather these times.

5. Tax Tips for Social Media Marketers

Taxes can be complicated, but with proper preparation, you can reduce stress and even save money. Here’s how:

– Track Deductions: Many business expenses are tax-deductible, including office supplies, travel, advertising, and software subscriptions. Be sure to keep receipts and categorize expenses.

– Stay VAT Compliant: If your revenue exceeds £90,000 (in the UK), you’ll need to register for VAT. Cloud accounting software can make VAT reporting and filing easier.

– Hire an Accountant: While it’s tempting to handle everything yourself, an accountant who understands the marketing industry can save you time and money. We’ll help with tax planning, VAT returns, and financial advice tailored to your business.

6. Scaling Your Business

As your social media marketing business grows, your accounting needs will become more complex. Here are a few tips for scaling efficiently:

– Automate Payroll. If you hire employees or contractors, consider payroll software that automates payments, taxes, and compliance.

– Outsource Bookkeeping: Free up your time to focus on client work by outsourcing bookkeeping to a professional. This ensures your financial records are accurate and up to date.

– Monitor Financial Metrics: Use your accounting software’s reports to monitor key performance indicators (KPIs) like revenue growth, profit margins, and cash flow trends.

7. Final Thoughts

For social media marketers, accounting may not be the most exciting part of the business, but it is one of the most important. Staying on top of your finances will help you make informed decisions, scale your business, and maintain profitability.

By using cloud accounting tools, setting aside money for taxes, and tracking your income and expenses carefully, you’ll be well-equipped to focus on what you do best: creating incredible social media campaigns and driving results for your clients.

Don’t hesitate to consult with an accountant, especially as your business grows. With solid financial foundations, you’ll be ready to take your social media marketing business to new heights.