Following a few calls from clients about stamp duty on second homes, we thought we’d do a brief blog about it.

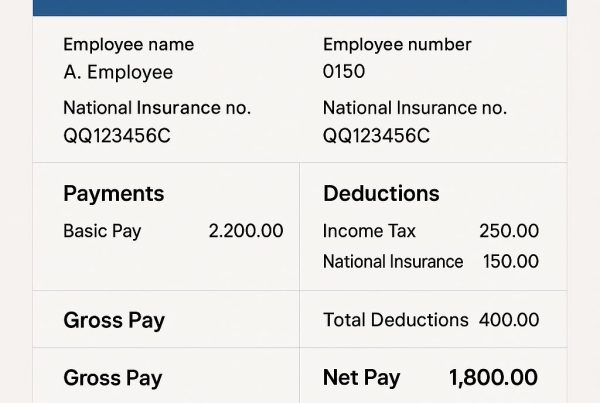

Stamp duty Land Tax (SDLT) is payable to HMRC on the purchase / completion of any residential property above £125,000.

Purchase price up to £125,000, SDLT rate Zero – additional properties are charged at 3%

£125,001 to £250,000 SDLT rate is 2% – additional properties are charged at 5%

250,001 to £925,000 SDLT rate is 5% – additional properties are charged at 8%

925,001 to 1.5m SDLT rate is 10% – additional properties are charged at 13%

1.5m or above SDLT rate is 12% – additional properties are charged at 15%

Stamp duty calculation

If you buy a second residential property costing £325,000, the SDLT calculation is as follows

£125,000 x 3% £3,750

£124,999 x 5% £6,250

£75,001 x 8% £6,000

Total SDLT due is £16,000

Please call us on 0151 931 2724 to discuss further, as it may be beneficial to purchase additional property through a Limited Company.