For small to medium-sized businesses (SMEs) , managing tax deadlines can feel overwhelming. With so many moving parts—Corporation Tax, PAYE, Income Tax, VAT—it’s easy to let a date slip through the cracks. But missing these deadlines isn’t just stressful—it can also lead to costly penalties and unnecessary headaches.

Let’s break down when your taxes are due and what happens if you don’t meet those deadlines.

Corporation Tax

If your business is a limited company, Corporation Tax is due on your profits. The due date for Corporation Tax is 9 months and 1 day after the end of your company’s accounting period.

Example: If your accounting period ends on 31st March, your Corporation Tax is due by 1st January of the following year.

What Happens If You Miss It? If you miss the Corporation Tax deadline, HMRC will charge interest on the amount owed from the day after it’s due. Additionally, if you file your tax return late, you could face a penalty of £100, with penalties increasing the longer you delay.

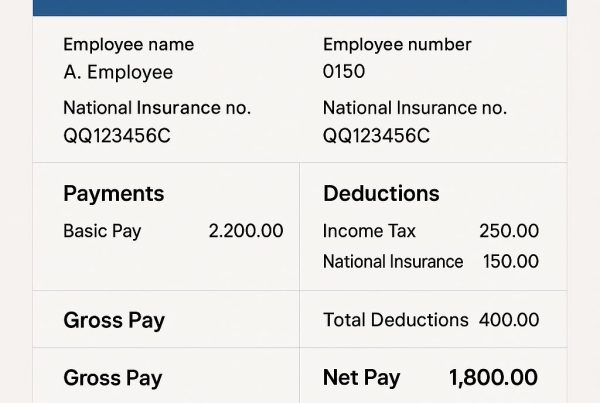

PAYE (Pay As You Earn)

PAYE applies to businesses with employees, including directors taking a salary. You must send your PAYE submissions to HMRC on or before the date you pay your employees. PAYE payments (Income Tax and National Insurance Contributions deducted from employees’ pay) are due monthly, typically by the 22nd of each month if you pay electronically, or the 19th of the month if paying by post.

What Happens If You Miss It? Missing PAYE deadlines can lead to late payment penalties. These penalties are based on how much is overdue and how often you’re late, ranging from 1% to 4% of the late amount, depending on the number of late payments in a tax year. Delays can also lead to stress, as HMRC may investigate and even issue penalty charges for repeated offenses.

Income Tax (Self-Assessment)

For sole traders, partners, and some directors, Income Tax is managed through self-assessment. Key dates to remember:

- 31st January: Deadline for paying your Income Tax bill for the previous tax year and for submitting your online self-assessment tax return.

- 31st July: Deadline for the second payment on account for the current tax year (if applicable).

What Happens If You Miss It? Missing the self-assessment deadline results in a £100 fine for being late, and this increases the longer you delay. After 3 months, HMRC can charge daily penalties of £10, up to a maximum of £900. If you’re six months late, expect a further penalty of 5% of the tax you owe or £300—whichever is greater. Failing to pay on time also leads to interest charges on the outstanding tax amount.

VAT (Value-Added Tax)

If your business is VAT-registered, (£90,000 turnover or more) you need to submit VAT returns to HMRC, usually every quarter. The VAT return shows how much VAT you’ve charged on sales (output tax) and how much VAT you’ve paid on purchases (input tax). VAT returns and payments are due 1 month and 7 days after the end of your VAT accounting period.

Example: If your VAT quarter ends on 30th June, your VAT return and payment are due by 7th August.

What Happens If You Miss It? Missing a VAT deadline lands your business in HMRC’s default surcharge regime, which can result in surcharges based on a percentage of the VAT due. These surcharges increase the more frequently you default. Penalties can range from 2% to 15% of the unpaid VAT, depending on how late and how often you miss deadlines.

Capital Gains Tax

If you sold a residential property in the UL on or after 6 April 2020, You must report and pay any Capital Gains Tax due on UK residential property within:

- 60 days of selling the property if the completion date was on or after 27 October 2021

- 30 days of selling the property if the completion date was between 6 April 2020 and 26 October 2021

The Stress of Missing Tax Deadlines

We get it—running a business is demanding, and taxes might not be the first thing on your mind. But here’s the truth: missing tax deadlines causes a cascade of stress. First, there’s the anxiety of owing money to HMRC. Then, the added worry of mounting penalties and interest on top of the original tax bill. Before you know it, you’re spending more time managing late taxes than actually running your business.

The good news? It doesn’t have to be this way.

Avoid the Penalties: Proactive Tax Planning

The key to avoiding penalties and reducing stress is proactive tax planning. By staying on top of your deadlines and planning ahead, you can minimize the risk of missing a payment—and save yourself from unnecessary fines.

At My Accountancy Hub, we specialise in helping SMEs like yours manage all aspects of tax compliance, from Corporation Tax to VAT and PAYE. We’ll keep track of your deadlines, file your returns on time, and make sure you avoid penalties, giving you the peace of mind you deserve. No more late-night panic over missed tax deadlines—just clear, proactive management so you can focus on growing your business.

Need help staying on top of your taxes? Get in touch with us today for a free consultation.